The exact workflow will be adjusted over time to achieve our goals optimally, but I provide here the description of the first iteration.

Participating companies provide a list of up to 20 factual statements describing how their activities impact the Common Good.

Voters cast their votes online

Common Good Coefficients δ are calculated from these votes.

Goods and services are exchanged. Buyers pay the same regardless of δ. Sellers receive an adjusted amount.

Anyone can examine the factual statements and blow the whistle on any inaccurate or false statement

Enforcement mechanism

There are several ways to enforce the Common Good adjustments:

- a government could implement it via taxation, in a similar way to a sales tax

- a local authority could use a local currency

- a group of individuals could implement it via blockchain technology

For simplicity, I will detail the implementation below assuming the third option: a decentralized vote determines the Common Good Coefficient δ. Participants of the system transact with a cryptocurrency I will call ethicap (ξ). The workflow for other options can easily be inferred.

Factual statements

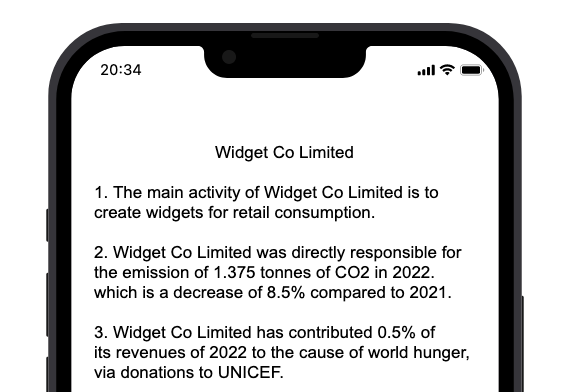

Companies provide a list of up to 20 factual statements, containing 200 characters or fewer each.

These statements are displayed on the online voting platform.

The first statements are answers to specific questions, common to all companies. The remaining are open-ended.

The current ways for citizens to analyze and evaluate companies’ behaviors (media reports, company filings, etc.) remain important, and these statements are not meant to replace, but to add to them.

Vote

Any individual may register with the voting platform. Their liveness and uniqueness are ensured by a Self-Sovereign Identity system. Once registered, they have the option to cast a vote at any time for any number of companies that sell their goods or services in ethicap.

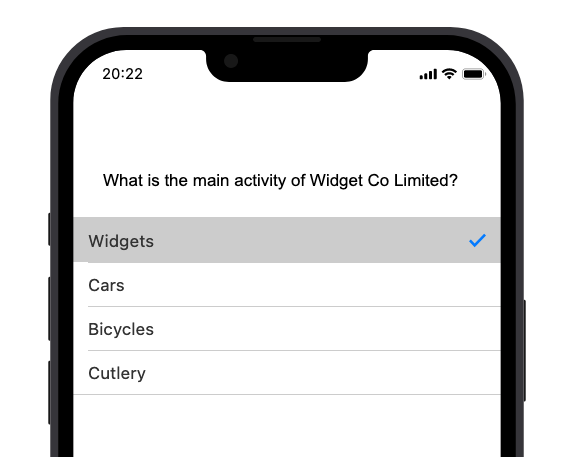

The vote is preceded by a short multiple-choice test to verify a basic understanding of the company’s operations.

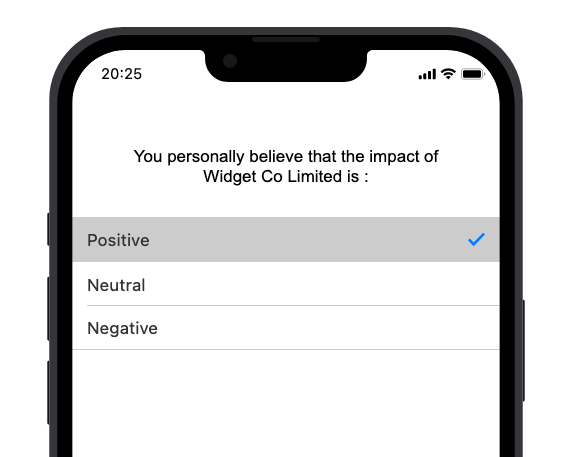

The vote is a simple choice between 3 options : positive impact, neutral, negative impact.

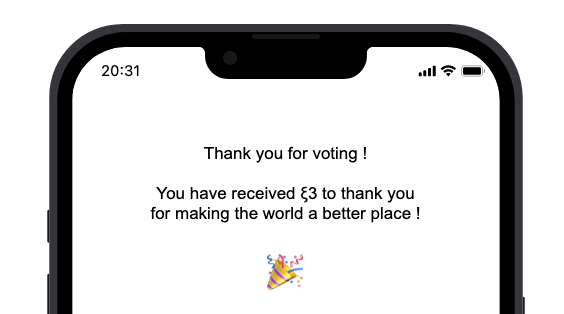

Each individual vote expires after 1 year. Votes can be changed at any time by the voter. A financial reward in the form of ethicap is provided to the voter for each vote cast (but not for vote changes within the year).

Common Good Coefficient

Let’s go together on a brief journey to choose how we convert votes to Common Good Coefficients. I promise to use more words than math symbols.

Definitions

Let \( C_i \) for \( i \in \{0, 1, … p \} \) be the companies participating in the system.

Let \( G_i \) for \( i \in \{0, 1, … p \} \) be the total sales of goods and services made by \( C_i \) during the previous year.

Let \( G \) be the total sales volume over the previous year :

$$ G = \sum_{i=1}^{p} G_i $$

Let \( n \) be the numbers of voters, and \( n_i \) the numbers of current votes cast about company \( C_i \).

Because each voter has 0 or 1 vote expressed about each company :

$$ n_i <= n \qquad \forall i \in \{0, … n \}$$

Let \( V_{i,j} \) for \( j \in \{0, 1, … n_i \} \) be all the current votes about \( C_i \) cast by all the registered voters.

\( V_{i,j} \) takes one of three values :

$$ \begin{cases} V_{i,j} = +1 &\qquad \text{when voter sees the company as beneficial} \\ V_{i,j} = \; \; \, 0 &\qquad \text{when voter sees the company as neutral} \\ V_{i,j} = -1 &\qquad \text{when voter sees the company as detrimental} \\ \end{cases} $$

Let \( V_i \) be the average vote of company \( C_i \) :

$$ V_i = \frac{1}{n_i}\sum_{j=1}^{n_i} V_{i,j} $$

Since \( \; V_{i,j} \in \{ -1, 0, 1 \} \; \) , \( \; V_{i} \in [-1, 1] \).

Let \( S \) be the average vote across all companies, weighted by their sales :

$$ S = \frac{1}{G}\sum_{i=1}^{n} G_{i} V_{i} = \frac{1}{G} \sum_{i = 1}^{n} \sum_{j = 1}^{n_i} G_i V_{i,j} $$

It economically makes sense to weigh by sales, because the real world situation is the same whether we have \( m \) companies with equal votes selling for \( G_i \) each, or one company selling for \( \sum_{i=1}^m G_i \). We therefore need our computation to reflect that by being invariant under all such transformations.

We define the score of a company by its normalized vote :

$$ S_i = V_i - S $$

This normalization ensures that the score of a company is relative to all other companies. This metric being positive means a company is doing better than its average peer, weighted by sales, not that voters see it as being beneficial in absolute terms.

Note that for clarity, I will ignore administration costs, whistleblowing mechanisms and deviation from equilibrium due to using sales estimate.

Constraints

So far, we have only defined some terms, and made no assumptions. It is time to think about our constraints.

The only economic constraint we have is to define our \( \delta_i \) in such a way that the flow of money in and out of the Common Good Fund tends to 0, in order to ensure solvency of the project (we can smooth out short-term deviations with reserve funds). In other words, we want:

$$ \sum_{i=1}^n G_i \times \frac{\delta_i}{100} = 0 \qquad (SOLVENCY) $$

Note that \( G_i \) is past sales, so we still have short-term deviations from equilibrium. We could get around that limitation by paying companies with a few days delay.

At this stage, we are looking for a function that transforms the votes \( (V_{i,j})_{1 \leq j \leq n_i} \) into \( \delta_i \), and satisfies our SOLVENCY constraint. There are infinitely many such functions. Rather than picking the first one that seems reasonable, we will set economically sensible constraints to narrow down the candidates :

- We want \( \delta_i \) values to be small enough for companies to be able to predict their cash flows, but big enough to make an impact. We choose 30%. Mathematically, we want \( \delta_i \) to be bounded by -30 and 30 :

$$ -30 \leq \delta_i \leq 30 \qquad \forall i \in \{0, …, p\} $$

- We want \( \delta_i \) to actually hit these bounds on its extremities. Mathematically :

$$ \begin{cases} \delta_i =& +30& \qquad &if \quad V_j = +1 \quad \forall j \in \{0, …, p \} \\ \delta_i =& -30& \qquad &if \quad V_j = -1 \quad \forall j \in \{0, …, p \} \end{cases} $$

- We do not want companies’ Common Good Coefficients to depend more strongly on their own sales. Mathematically, we want the derivative of \( \delta_i \) with respect to \( G_i \) to be the same order of magnitude as the derivatives of \( \delta_i \) with respect to any \( G_j \) :

$$ \frac{\partial \delta_i}{\partial G_i} \approx \frac{\partial \delta_i}{\partial G_j} \qquad \forall i,j \in \{0, …, p\}^2 $$

- We want Common Good Coefficients to depend little on the sales numbers of any company. This is possible only with a large enough set of companies, where none dominates in term of sales. Mathematically, we want the derivative of \( \delta_i \) with respect to \( G_j \) to tend to 0 when \( \frac{G_j}{G} \) tends to 0 :

$$ \lim_{\frac{G_j}{G} -> 0} \frac{\partial \delta_i}{\partial G_j} = 0 \qquad \forall i,j \in \{0, …, p\}^2 $$

This narrows down significantly the number of candidates… though we still have an infinite number of possibilities (infinity is whimsical like that). It is therefore time to choose sensible, but less necessary constraints :

We want \( \delta_i \) to be a function of \( S_i \) rather than the full series \( (V_{i,j})_{1 \leq j \leq n_i} \). This makes sense because \( S_i \) is the economically sensible quantity to consider, as explained in the previous section. This means we are reducing the series of all votes to its average. Given that votes can take only values in \( \{ -1, 0, 1 \} \), outliers are not a concern, this is a reasonable choice.

We want \( \delta_i \) to be linear in \( S_i \), because this is the simplest and most natural choice. Had we wanted our function to hit \( -30 \) and \( 30 \) at \( S_{min} \) and \( S_{max} \) instead of \( -1 \) and \( 1 \), we’d have needed a piecewise linear function. This would have also been a reasonable choice, but not continuous and slightly less simple.

Voilà! We have now reduced the set of candidates to exactly 1.

Final formula

$$ \bbox[30px, border: 2px solid]{\delta_i = 30 \times \underbrace{( \frac{1}{n_i}\sum_{j=1}^{n_i} V_{i,j} - \frac{1}{G} \sum_{i = 1}^{n} \sum_{j = 1}^{n_i} G_i V_{i,j} )}_{\text{Company score } S_i}} $$

Transactions

Buyers can be any individual possessing ethicap. They do not have to be voters.

Let Widget Co be a registered company with Common Good Coefficient δ = 20, selling widgets for the price of ξ100.

Buyer purchases the widget by paying ξ100 via their ethicap credit card or by ethicap transfer. Widget Co must receive ξ120 because of their δ, so an additional ξ20 is automatically taken from the Common Good Fund and added to the company’s wallet via smart contract.

As we can see, the buyer is not impacted by the company’s Common Good Coefficient. This avoids conflict of interest when voting.

Whistleblowing

Factual statements submitted by companies can be denounced as 1) misleading claim or 2) false claim. When a whistleblower submits a challenge to a specific claim, the community is asked to vote on it.

Should the statement be found misleading, the company pays a penalty equivalent to one month of their sales. Should the statement be found false, the penalty is equivalent to one year worth of sales. The calculation of the one month/one year equivalent value is performed by looking at the past year, or the time since joining the system if shorter, and calculating the pro rata value. The whistleblower receives the entire penalty.

The only requirement to be a whistleblower is to be a registered voter. Any voter is allowed to challenge without success only twice. They recover one challenge option after 1 year.

Convince companies

In the early stages of the projects, a challenge will be to convince real companies to enter into this system. From their perspective, that means selling some goods and services in ethicaps (ξ), so that the rules of the Common Good Coefficient are enforced. There are a few ways to incentivize them :

Incentive payments in ethicaps (

ξ)At creation time of ethicap (

ξ), we save some amount specifically designed to incentivize early participants.Incentive payments in fiat currency

We can pool fiat currency to incentivize participants.

Negative delta is not paid to the fund

For the first stages, we can waive the price impact of a negative delta, so that companies are guaranteed to sell at the minimum price they set.

Companies can showcase their ethical credentials

Many companies are investing serious amounts of money to not only be more ethical, but also prove that they are so. As an example, large companies are hiring entire teams to implement the rules dictated by B corp. They go through the pain and costs of adapting their process, and on top of that, they actually have to pay B corp for them to review their case and potentially attribute some sustainability certificate. Companies can view their participation in Ethical Capitalism as a way to have their behavior assessed by a group representing the Common Good, in a bottom-up manner, rather than analyzed and accredited by a top-down institution. Given the increasing distrust of institutions, it could be seen as a must-have to have the backing of truly independent citizens, who do not have a conflict of interest because they are not paid by the company to review their case.

Activism can push companies to enrol

This project creates a new avenue for ethical activism. Rather than pushing companies to adopt specific practices, they can simply encourage them to participate in this Ethical Capitalism ecosystem, so that they become truly accountable. That ensures companies behave ethically on the long term, on a broad range of subjects, without time-consuming monitoring by social activists.

Market access

By offering their goods or services in ethicap (

ξ), companies get access to a market otherwise unavailbale to them. This is an appealing proposition, whether they believe in the idea or not, particularly as the project grows.